Table of Content

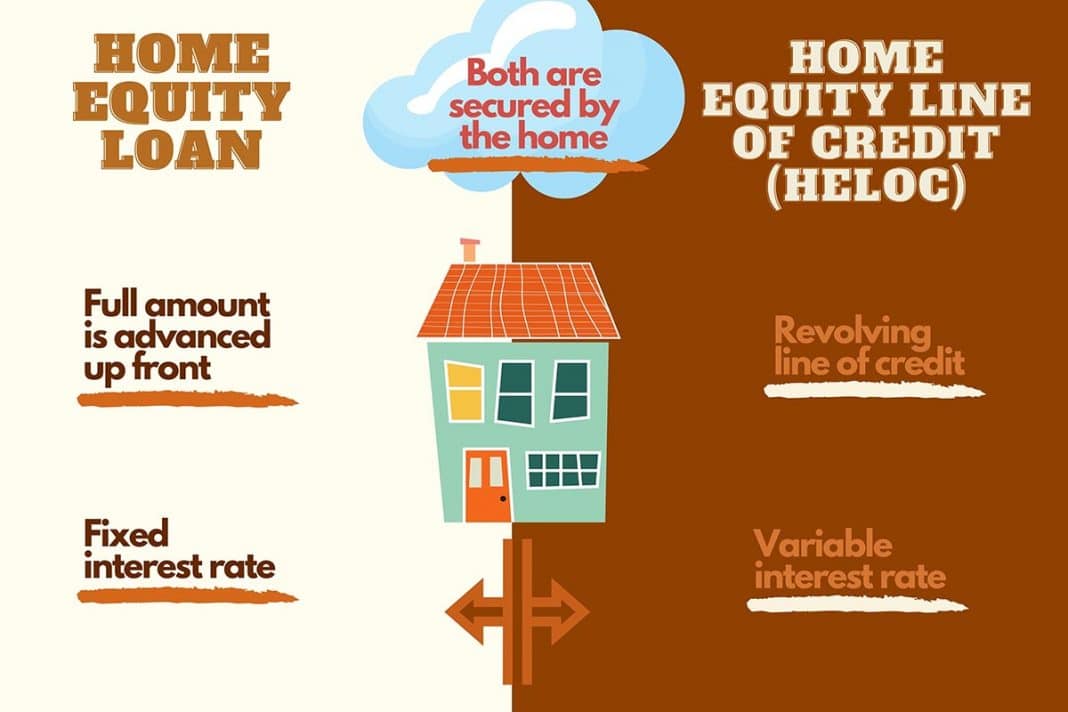

The two major differences are the way you receive the money and how you pay it back. Now, borrowers with excellent credit and sufficient equity can secure home equity loans with interest rates as low as 5% to 6%, according to Bankrate. While a home equity loan is a low interest rate financing option, it's not without risk. When you secure the loan, your home acts as collateral, which means you could lose your home if you're unable to repay what you borrowed.

A rough rule of thumb is that the amount of equity you have in your home is the home’s value minus any outstanding loans on the property, like your mortgage. You can use our home equity loan calculator for a more precise calculation. Customer support by phone is available on weekdays from 8 a.m. But, it’s important to know you’re leaving the A+FCU website.

Finally compete and win with MortgagePass.

You'll also want to make sure you're comparing loans with the same terms or lengths. A home equity loan can be a good idea if you're a homeowner who has at least 15% to 20% equity built up in your property and you need access to low interest-financing. But home equity loans also come with risks that are important to understand when deciding if one is right for you. Apply directly via the form below for the position of Graduate Equity Analyst. Please provide us with a CV and letter of motivation in English.

Although home equity loans have higher rates than mortgages, they usually have lower fees. That’s because you have to pay closing costs as a percentage of the entire loan amount. HELOC rates start a 4 percent APR if you pay $400 for discount points. Otherwise, rates start at 4.25 percent APR, which comes with a $500 credit toward closing costs. Lower’s HELOC has a five-year draw period and a repayment period ranging from five years to 20 years. Founded in 2018, Lower is a direct mortgage lender that is part of Homeside Financial.

The Person-trade-off Approach to Valuing Health Care Programs

No prepayment penalty—you can pay off your loan early, simple as that. Access up to 95%³ of your home’s value while keeping your existing mortgage. Using your home equity for debt consolidation can be a smart move for a number of reasons. While considering these options, remember that there’s no single correct answer. As everyone’s needs differ, so will their optimal approach to borrowing. If you qualify, a home equity loan or HELOC is relatively easy to get.

It does help you save in the long term, but with less time to pay, 15-year mortgages have higher monthly payments. Like regular mortgages, home equity loans have closing costs, such as origination fees, recording fees, and appraisal fees. To do a fair, apples-to-apples comparison of the rates charged by different lenders, you'll want to focus on each loan's annual percentage rate . In addition to the loan's basic interest rate, the APR takes some of the loan fees into account, giving you a more accurate picture of what you'd really be paying to borrow.

Calculate home equity loan options

Get a low monthly payment and zero origination fees or cash required at closing. Your CLTV ratio is the sum of anything you owe on the house—say a mortgage and a home equity loan—divided by the value of the property. Most lenders prefer you to borrow no more than 80% of your CLTV, but some will go up to 90%. The lowest APR quoted is for loan terms of five years to 15 years and a minimum borrowing of $5,000.

The company’s application process for HELOCs can be completed entirely online. You’ll start by providing your name, email address and phone number, after which you’ll get a call when a loan specialist gets your information. You will likely need a good credit score and a debt-to-income ratio of less than 50 percent in order to be approved for a loan. You might qualify with a credit score as low as 620, but a score of 700 or higher will get you the best rate, according to the company. You are leaving Discover.com and entering a website operated by a third party.

Does My Existing Loan Have a Low Rate?

In addition to a fixed-rate home equity loan and a variable-rate HELOC, Lower offers mortgage purchase and mortgage refinance loans. Both of its home equity products offer loans of $15,000 to $350,000, with the maximum amount varying based on your state and your loan-to-value ratio, or LTV. Lower allows up to 95 percent LTV, which is more than most home equity lenders. The rates shown above are for loans from $50,000 to $99,999 for a borrower with a credit score of at least 730 and up to 70% loan-to-value ratio. To get the lowest rate, the bank also requires customers to make automatic payments from a U.S. With a home equity loan, you typically receive a one-time lump sum of money at a fixed interest rate that you then repay over time.

We also graded them based on credit access and speed to close as well as whether they offer low fees or discount promotions. There is also an additional three business day Right of Rescission period before the loan can be funded, which is required by both state and federal laws. With the required waiting periods, the minimum time it will take to receive your money is 15 days, but this will depend on processing time and weekend or holiday schedules. U.S. Bank does offer home equity loans and Bank of America only provides home equity lines of credit with a variable interest rate. While the small town bank may know your name, its rates may or may not be competitive. Still, if you already have an account at a local bank, it's a good place to start your search for a home equity loan.

Learn the requirements for a second mortgage and how to apply. Home equity is the calculation of a home's current market value minus any liens attached to that home. Fees are another important consideration in comparing loan costs.

Once satisfied with the terms, you’ll complete a more thorough application. The lender, in turn, will then do a more thorough underwriting. This includes performing a hard pull of your credit report and requiring proof of your income. As we’ve covered cash-out refinancing elsewhere on our website, we’ll focus primarily on home equity loans and HELOCs in this article. One potential downside of a home equity loan is that if your property value goes down for any reason, you could end up underwater on your loan. This happens when the balance of your loan becomes higher than the value of your home.

You can sell your house in the future and consider the equity as your profit. The analysis suggests that the notion of a 'fair innings' notion of intergenerational equity requires greater discrimination against the elderly than would be dictated simply by efficiency objectives. More information on how Optiver Europe processes your personal data can be found in our Privacy Policy. Are you an aspiring Equity Analyst and do you have an analytical and competitive nature? If so, then you just might be the perfect fit for our equity research team. To learn more about the different rate averages Bankrate publishes, see "Understanding Bankrate's Rate Averages."

Her work has been published by Experian, Credit Karma, Student Loan Hero, and more. Here's a breakdown of some of the benefits and drawbacks of Lower home equity loans. We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

It may have an extra incentive to offer you a lower rate or some reduced fees in hopes of keeping your business. Home equity loans typically have fixed, rather than variable, interest rates, so once you've signed up for one, your payments should be predictable and not result in any unpleasant surprises. Lower® and its DBAs provide home loans; Lower Realty, LLC provides real estate services; Homeside Insurance Services, LLC facilitates shopping experience for homeowner’s insurance policies. No matter which option you choose, refinancing with Lower can save you money. Although home prices rose more than 42% since the beginning of the pandemic, the impact of rising mortgage rates is starting to show as home prices begin to decline. If your property loses value and is worth less than you paid for it, and if you've taken out a home equity loan in addition to your mortgage, you could end up with negative equity.

No comments:

Post a Comment